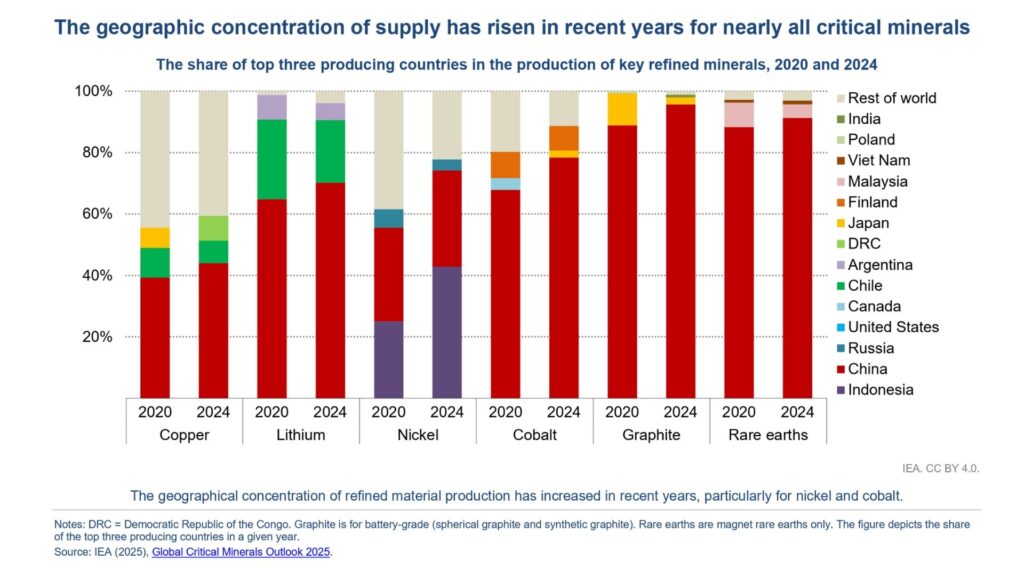

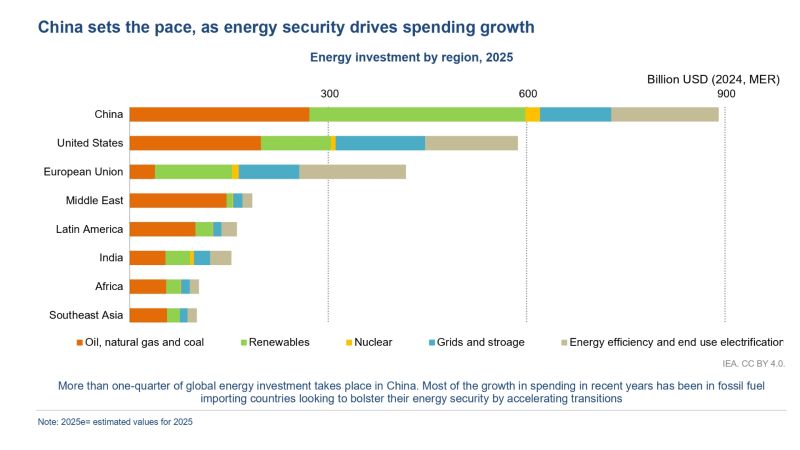

The latest International Energy Agency (IEA) report leaves little room for doubt: China now dominates investment in the energy transition and leads, by a wide margin, in both the refining and manufacturing of critical minerals. It is not only the largest exporter of solar and battery storage technologies; its role across the value chain continues to expand year after year.

In 2024, global investment in critical minerals outside traditional producers slowed. At the same time, Chinese companies deepened their vertical integration across the chain and increased their market share. The takeaway is clear: those who control access, processing and export of these inputs will determine much of the pace and direction of the energy transition.

Where does Latin America stand in this scenario?

The region holds some of the world’s largest reserves of critical minerals—but the challenge lies not only in resource availability, but in the ability to attract investment, build robust regulatory frameworks, and create local value. Remaining merely an exporter of raw materials would mean giving up a leading role in one of the most significant global transformation processes of our time.

The opportunities are real and well defined:

- To capitalise on global demand with clear and predictable rules.

- To develop local value chains and industries beyond simple extraction.

- To align international financing and sustainability commitments with the region’s own development model.

The energy transition will move forward—with or without Latin America’s active participation in these strategic links of the value chain. But the outcome will depend greatly on the decisions made today regarding institutional strength, industrial integration, and regional strategy.

The challenge is not whether we have the resources. It is how we played in the new map of global investments.