The Insurtech market: maturity and recalibration of global investment

The global insurtech market is entering a period of recalibration.

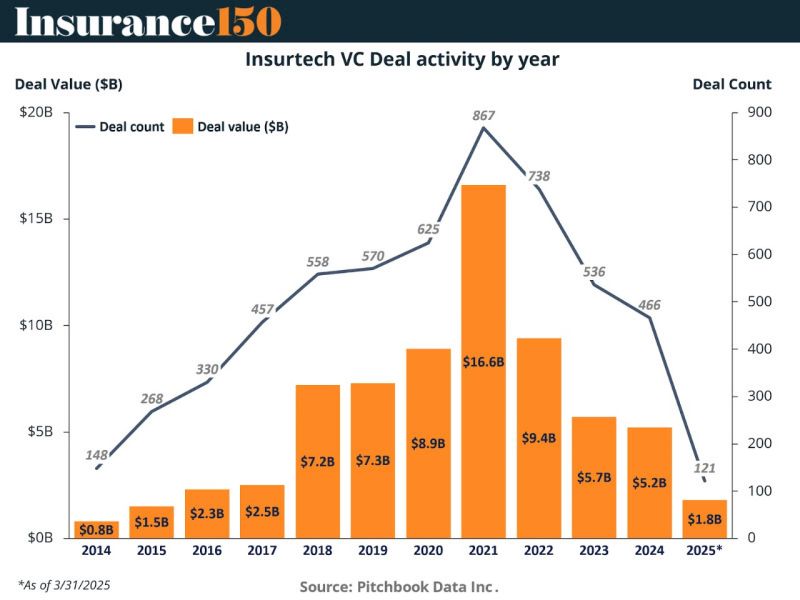

After the historic investment boom of 2021—when VC funding reached USD 16.6 billion and dozens of unicorns were created—the sector now shows signs of maturity. Funding is down, and investors are prioritising quality over quantity. Start-ups are expected to demonstrate sustainable results.

The decline in investment and the acceleration of technology

From that peak, VC investment fell to USD 5.2 billion in 2024. In the first quarter of 2025, only 121 deals were completed globally.

This has pushed verticals such as embedded insurance, AI, predictive analytics, blockchain and IoT to accelerate their evolution and adapt—across multiple industries.

Geographically, North America continues to lead in volume and impact. However, Europe has firmly consolidated its position as a strong hub, while Asia is emerging as a locus for experimentation and scale.

The market has become more demanding. Operational discipline now matters as much as technology. As a result, leadership is no longer concentrated in a single country or region.

The question of maturity

The key question is whether this more mature phase will benefit already established players—or, conversely, open the door for a new wave of start-ups. How do you see it?