The acquisition of Adecoagro by Tether: the intersection between crypto and agriculture

The acquisition of Adecoagro by Tether is not just a headline-grabber. It signals how the boundary between the digital economy and the physical world is blurring.

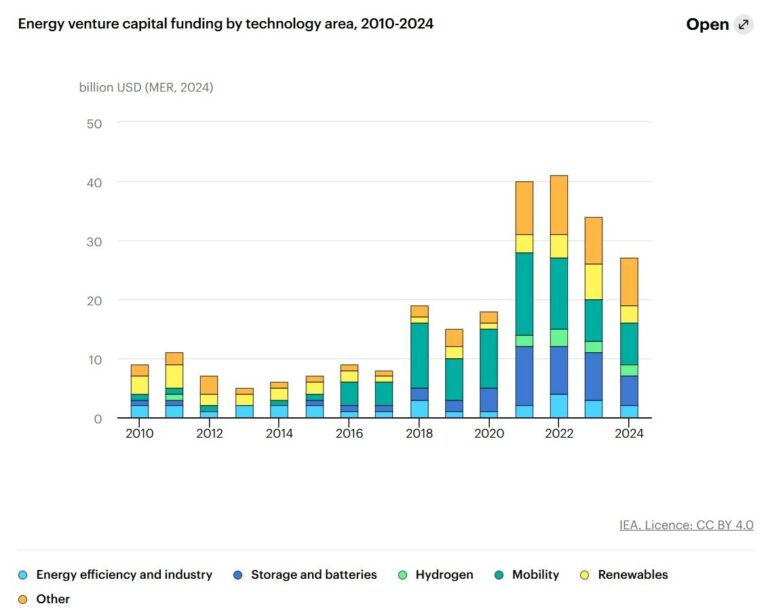

A cryptocurrency giant is investing in farmland, processing plants and renewable energy, aiming to improve the liquidity and efficiency of its stablecoin in commodities trading.

Implications for the sector

From an industry perspective, this raises several questions—and opportunities.

On the one hand, it shows how physical assets are starting to be conceived as “programmable” financial instruments, capable of being integrated into instant, global payment systems.

On the other, it sets a new scenario for producers and exporters, offering faster payments, lower transaction costs and new forms of financing linked to cryptocurrencies.

While Tether is beginning by using Adecoagro’s renewable energy for bitcoin mining operations, it is clear that the line between agriculture, finance and technology is entering a phase of experimentation—bringing regulatory and market implications that all players in the sector should monitor.

Here is the full article.